FREE Break Even Point Calculator

You can easily calculate the break-even by using our break-even point calculator. And it is absolutely free.

Measuring is straightforward, and you need three things—fixed and variable costs and sales price per unit. Just enter the data in our calculator and get the results.

What Is the Break Even Point?

The break-even point defines a situation when a company’s revenues will be equal to its cost within a designated accounting period. In simple words, we call it ‘broke even—as it means no net losses or profits for that company.

With the break-even point, you will understand when your company or products will start to gain a profit. A company running at a loss will have revenues below the BEP (Break Event Point), and a company running at a profit will have it above the BEP.

How to calculate the break-even point?

There are two ways to calculate break even point:

- The Break-even Point formula in units is— Fixed costs divided by the Sales Price per Unit minus the Variable Cost per Unit.

- The break-even point formula in dollars is— Fixed Costs divided by Contribution Margin.

The contribution Margin is deducting the Variable Cost per Unit from the Price per Unit. Now just dividing the result by the Price per Unit.

- Fixed costs: The fixed costs will not change on sales volume. It includes factors like rent you paid for production facilities, storefronts, software, or computer.

- Variable costs: Variable costs depend on the sales volume, such as materials for manufacturing or the production of items.

- Price per unit: It is a calculation for one of the products for which a company will charge consumers.

- Contribution Margin: This ratio is crucial to determine what you can break even, like raising the prices or reducing the production cost. With the contribution margin, you have to cover the fixed rate. And the rest amount will be your profit.

- Profit earned: The break-even point is reached when variable and fixed costs are equal, and you can make a report of net profit or loss of 0$ based upon it. And the net profit will be selling any item beyond that point.

How to use the Break Even Point Calculator?

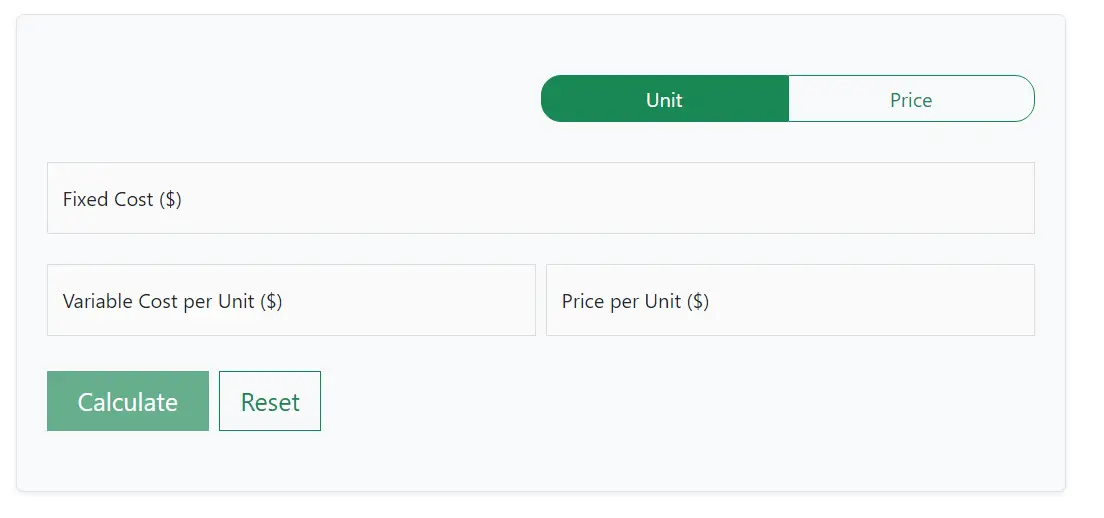

- First you have to decide if you want to do it by unit or based on price.

- After that you just need to put in the fixed cost, Variable Cost per Unit if you did it based on unit or Total Variable Cost if you did it based on price.

- Next up, if it’s for price, then you want to put in number of units. If it’s for unit, you want to put in the price per unit.

- Lastly, hit the calculate button and let the calculator do the work for you!

Break Even Point Examples

Let’s assume a company wants to introduce a new shampoo in the market but also wants to know the overall financial impact after launching the item.

So, the company decides to measure the break-even point so that the team can identify whether the investment in that product will be a good decision or not.

So, the costs for the first month of that product,

Calculating in units

The Break-even Point formula in units is— Fixed costs divided by the Sales Price per Unit minus the Variable Cost per Unit.

- Fixed costs = $ 1,000 (for one month)

- Price per unit = $2.50

- Variable costs = 0.60 (per bottle)

Formula: Fixed Costs / (Price per Unit – Variable cost per unit)

$1,000 / ($2.50 – $0.60) = $1,000 / 1.9 = 526 units.

The company has to sell over 526 shampoo bottles in the first month to achieve the break-even point.

Calculating in dollars

The break-even point in dollars is Fixed Costs / Contribution Margin.

So, the result is — $1000 / 0.76 = $ 1315

In order to break even in the first month, the company needs to sell $1315 worth of shampoo. The amount above that can be considered as the profit for that company.

What is a fixed cost?

These are the expenses you need to deal with for selling or producing a product. It does not rely on the number of products sold or the manufacturing level. Some factors included in fixed costs are rent, taxes, salaries, energy, and labor cost. These factors will not change if the production or the selling increases.

What is a variable cost?

The variable costs are determined by the number of products available for sale on the market or the production level. It works on a per-unit basis, which means selling more units means increasing the variable costs. Some common factors are delivery charges, prices of raw materials, and packaging costs.

Why is Break Even Point Important? Can it help your business?

- As the business owners know when or at which point they can break even, it will be easy to set the budget and do accordingly. It will help to build a realistic target for that business.

- Fixed and variable costs can affect the profit margin of a business. But with the break-even analysis, the company can detect if the effects are changing costs or not.

- During a financial crisis, the sales of any business tend to lower, but with the break-even point, you can deal with this. It will help you decide the least numbers of sales you need to make the profits, and with this report, you can set high business decisions.

FAQs

Is the Break-Even Point Calculator by eComBusinessHub Free to Use?

Yes, our break-even point calculator is totally free of cost.

Is Break-Even Point useful for dropshippers?

Yes, absolutely. Break-even point analysis can help dropshippers determine what sales volume they need to achieve to cover the costs.